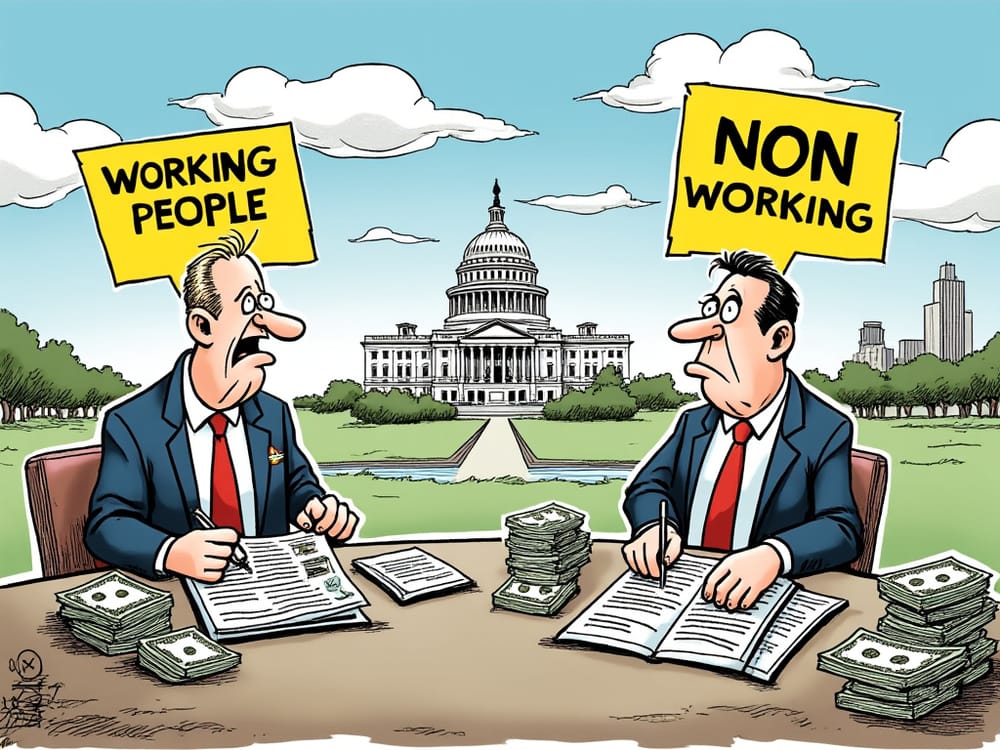

The Labour budget: you will own nothing, and you will be happy!

Keir Starmer had made it clear. If you have assets, you are not a working person. And if you are not a working person, you are free game. He has now delivered on that promise. The new budget, under the pretence of filling an imaginary hole of £22bn, aims to increase the tax take by £40bn (even if it probably won't be achieved) and adds another £70bn in government spending. Let's do a quick roundup of the major changes announced this week.

The Good

While there may not be much to celebrate in this budget, there is a sense of relief as the outcome could have been more severe. The capital gains tax has risen, though not for property, and not to the level where capital gains tax rates equal those of income tax. This softening represents a compromise that spares many investors from the full force of income tax parity and acknowledges the different nature of risk inherent in investing versus earning a salary.

Another glimmer of good news came in the form of the government resisting the pressure to introduce an exit tax. For many, especially entrepreneurs contemplating a move abroad or even those considering an international retirement, this is significant. The introduction of an exit tax would have been seen as a desperate measure, aimed at locking wealth within the borders. Its absence signals that the government is, for now, unwilling to go down the road of more draconian wealth containment measures that some feared.

The Bad

Huge Increase in Minimum Wage

The announcement of a substantial increase in the minimum wage will be painted by some as a step towards a fairer society. However, the reality on the ground for many small and medium enterprises (SMEs) is far less rosy. The combination of soaring wages with the ongoing economic stagnation means that SMEs will face an increasing squeeze. The cost burden will either force businesses to raise prices—contributing further to inflation—or will simply push many firms to the brink of insolvency. The concern here is that this measure will ultimately serve to consolidate market power into larger corporations, which can afford to absorb such changes, to the detriment of local businesses.

Double Whammy on NIC for Employers

In addition to the minimum wage increase, employers are set to face a double blow with the changes to National Insurance Contributions (NICs). Not only are the rates set to rise, but the tax-free thresholds are being lowered, dragging in businesses that previously did not meet the criteria. This combination is effectively a stealth tax that disproportionately impacts employers. The result is that the cost of employment continues to rise, making the United Kingdom a less attractive destination for setting up businesses or expanding operations. For an economy still reeling from post-Brexit uncertainties, the optics of further penalizing employment are far from reassuring.

Progressive Disappearance of BADR

The gradual erosion of Business Asset Disposal Relief (BADR), once Entrepreneurs' Relief, is another regressive step. BADR has been instrumental in encouraging entrepreneurship, making the UK a more attractive place to build and eventually exit a business. Its slow phasing out sends a signal to budding entrepreneurs: the incentives for taking a risk and establishing a business in the UK are diminishing. This is likely to have long-term consequences, potentially reducing the number of startups in the country and further dulling the UK's competitive edge in global markets.

The Ugly

IHT for Farming

One of the most worrying measures in this budget is the extension of Inheritance Tax (IHT) provisions to farmland. Historically, the farming sector has benefited from specific exemptions designed to recognize its importance in maintaining food security and the rural economy. By stripping away these IHT advantages, the government is jeopardizing the continuity of family-run farms, many of which are already struggling with high input costs and competitive pressures. This measure, quite bluntly, risks hollowing out the farming industry, pushing more land into corporate hands or into non-agricultural use, and exacerbating food dependency issues.

CGT for Accrued Interest

Another headline-grabbing change is the decision to significantly increase Capital Gains Tax (CGT) to accrued interest, particularly affecting those in private equity. The initial first step is to increase the rate to 32% but with a promise to revisit this rate next year to make it more in line with income tax rates. For years, the private equity sector has enjoyed a competitive tax structure, enabling the UK to be a hub for investment and private capital. By targeting accrued interest, the government is making it clear that it sees the wealth generated through these mechanisms as fair game. This change will undoubtedly make private equity firms reconsider their presence in the UK, likely choosing to relocate to more tax-friendly jurisdictions. This measure risks undermining a sector that has, for better or worse, played a role in stimulating business investment in recent years.

Additional SDLT Rate to increase from 3% to 5%

The increase in Stamp Duty Land Tax (SDLT) additional rate to 5%, which could bring the SDLT rate to a whopping 17% in the case of enveloped dwellings, is another ill-conceived attempt to generate revenue. The buy-to-let (BTL) market has already been under severe pressure, and this additional layer of tax is yet another deterrent. For landlords, it effectively signals the end of the road for profitable investment in the rental property market. Ultimately, this will shrink the supply of rental properties, drive up rental prices, and put increased strain on already financially stressed renters. The government’s move seems more ideologically driven than economically rational, targeting perceived 'wealthy landlords' while ignoring the broader economic consequences.

Conclusion

The 2024 UK budget is a clear statement of intent from Keir Starmer's government. The message is that those with assets, those who invest, and those who create jobs are to be taxed more heavily to balance an ever-expanding expenditure column. While some measures have thankfully been less severe than anticipated, the direction is unmistakably clear. This budget reflects an ideological stance that wealth is to be redistributed by increasing the tax burden on those who generate it. The long-term consequences—a less attractive UK for businesses and investors, increased costs for SMEs, and a crumbling farming sector—are concerning, to say the least. Whether this budget fills the £22bn 'hole' or instead creates new ones for the future remains to be seen.